On April 12, 2024, the Shanghai, Shenzhen, and Beijing Stock Exchanges officially released the Self-Regulatory Guidelines for Listed Companies' Sustainability Reporting (hereinafter referred to as the "Guidelines"). This is the first systematic and standardized sustainability reporting guideline issued by regulatory authorities in mainland China, marking a new stage of standardized and unified sustainability reporting for listed companies with Chinese characteristics. Its importance cannot be overstated.

Overall, apart from differences in formulation basis and scope of application, the guidelines released by the three exchanges are basically consistent in content structure and details, all divided into six chapters. Chapters One (General Provisions) and Two (Sustainability Reporting Framework) outline general requirements, while Chapters Three, Four, and Five specify disclosure requirements for environmental, social, and governance-related aspects, respectively. Chapter Six includes additional provisions and definitions. The guidelines also append an index of topics, listing the specific topics and corresponding clauses for easy reference by enterprises. The following sections provide a detailed interpretation of the guidelines.

Chapter One: General Provisions

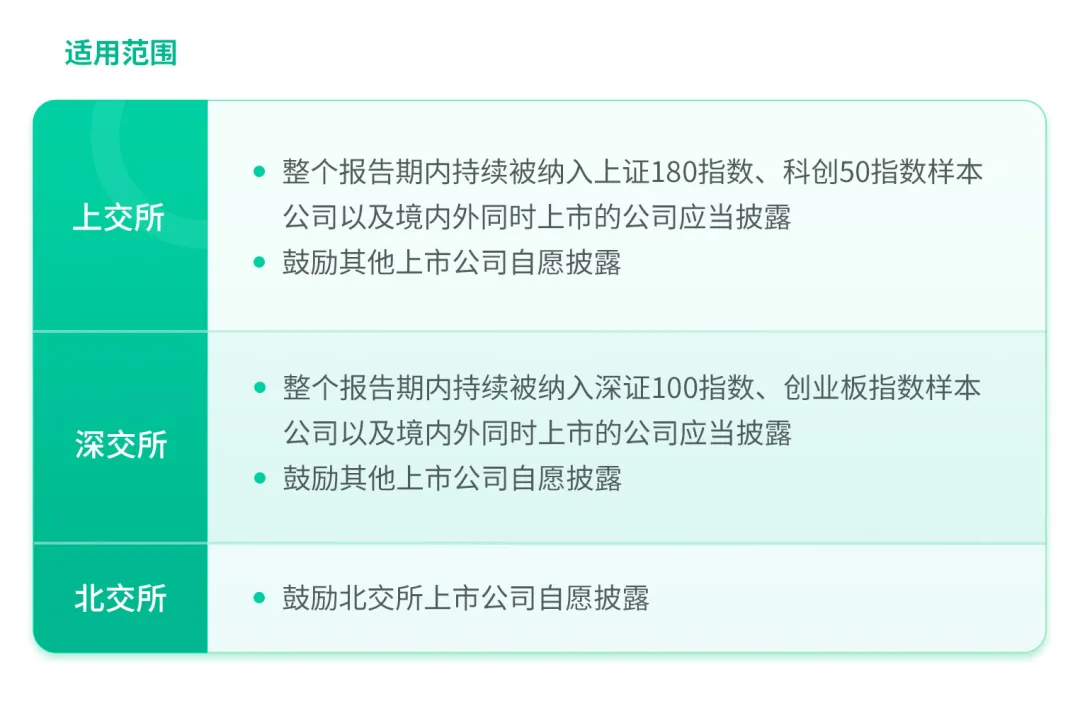

The General Provisions clarify the basis and philosophy of the guidelines, detailing the scope of application, disclosure timing, reporting entity, reporting period, and requirements for materiality analysis and stakeholder engagement.

[Disclosure Timing]

Within 4 months after the end of each fiscal year, the report shall be approved by the board of directors and disclosed no earlier than the annual report.

[Reporting Entity]

The reporting entity should be consistent with the annual report.

[Reporting Period]

The reporting period should be consistent with the annual report.

[Materiality Analysis]

Identify material topics by considering both financial materiality (whether they significantly impact the company's value) and impact materiality (whether they significantly impact the economy, society, and environment), and explain the process of analyzing topic materiality. (Introduces the "double materiality" requirement, aligning with GRI and EU CSRD requirements)

[Stakeholder Engagement]

Through interviews, seminars, and surveys, understand and gather opinions from stakeholders, paying attention to their concerns and needs.

Chapter Two: Sustainability Reporting Framework

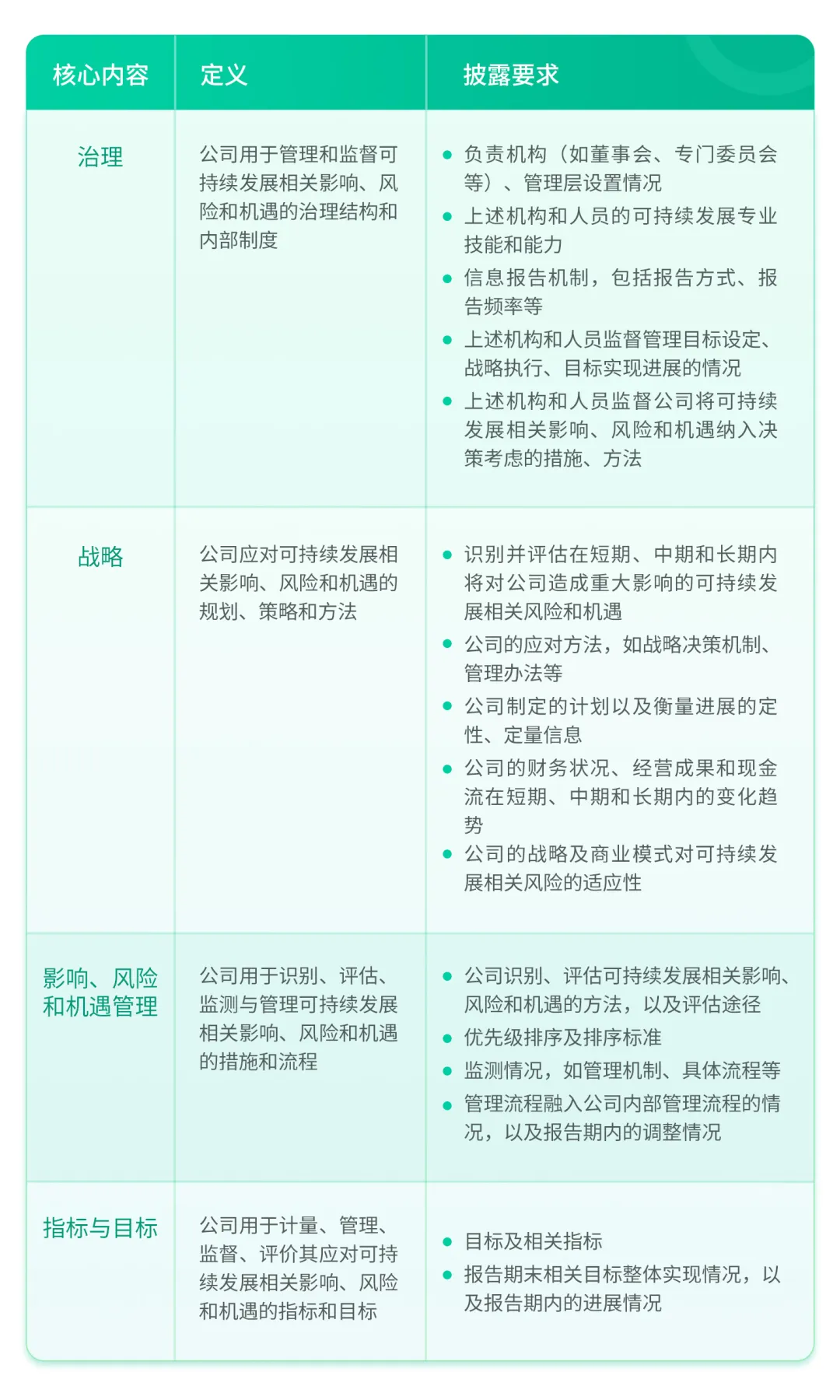

For topics identified as financially material during the materiality analysis, the company should analyze and disclose the topics around four core elements: governance, strategy, management of impacts, risks, and opportunities, and metrics and targets. (This framework aligns with ISSB and TCFD requirements)

Chapters Three to Five: Specific Topic Disclosure

The guidelines cover 21 topics across environmental, social, and governance-related aspects, setting differentiated disclosure requirements through a combination of qualitative and quantitative, mandatory and voluntary approaches.

[Environmental Disclosure]

Emphasizes climate change response and sets topics such as pollutant emissions, waste management, ecosystem and biodiversity protection, environmental compliance, energy utilization, water resource utilization, and circular economy.

Key performance indicators include Scope 1 greenhouse gas emissions, Scope 2 emissions (Scope 3 emissions where applicable), pollutant emissions and reduction targets, waste generation and reduction targets, energy and water usage and conservation goals, etc.

[Social Disclosure]

Covers Chinese characteristics and sets topics such as rural revitalization, social contributions, innovation-driven development, ethical technology, supply chain security, fair treatment of small and medium-sized enterprises, product and service safety and quality, data security and customer privacy protection, and employees.

Key performance indicators include investments in public welfare and volunteer activities, R&D investment and its proportion of main business revenue, number and proportion of R&D personnel, number of invention patents applied for and authorized, amount involved in customer privacy breaches, gender and age composition of employees at the end of the reporting period, number of employee training sessions, etc.

[Governance Disclosure]

Besides establishing a sound corporate governance mechanism, emphasis is placed on disclosing due diligence, stakeholder engagement, anti-commercial bribery and anti-corruption, and anti-unfair competition.

Key performance indicators include the total number and percentage of directors, management, and employees who have received training on anti-commercial bribery and anti-corruption.

Chapter Six: Additional Provisions and Definitions

[Effective Date]

The guidelines take effect on May 1, 2024.

[Transition Period and Mitigation Measures]

Listed companies within the mandatory disclosure scope should prepare and publish the 2025 Sustainability Report according to the guidelines by April 30, 2026, and are encouraged to write the 2024 Sustainability Report according to the guidelines.

For the first reporting period, year-over-year changes in related indicators do not need to be disclosed; for indicators with difficulty in quantitative disclosure, qualitative disclosure and explanation of the reasons for not quantifying are acceptable, except for those already quantitatively disclosed previously.

[Verification Requirements]

If a company hires a third-party institution to verify or audit the Sustainability Report, it should disclose the independence of the institution, its relationship with the reporting entity, and its experience and qualifications, along with the verification or audit report. The report should include, but is not limited to, the scope of verification or audit, the standards relied upon, main procedures, methods, limitations, and opinions or conclusions.

[Key Points Summary]

1. Materiality analysis is a key driver, and the reporting framework and content differ based on the results of the materiality analysis. The guidelines require the use of the double materiality principle in topic identification, with separate mandatory disclosure requirements for financial materiality and impact materiality. Only topics that meet financial materiality (including those that meet both financial and impact materiality and those that only meet financial materiality) need to be analyzed and disclosed around the four core elements: governance, strategy, management of impacts, risks, and opportunities, and metrics and targets. For topics that only meet impact materiality, companies should disclose relevant information according to the specific provisions of the guidelines (i.e., Chapters Three to Five). Finally, for topics that do not meet either financial or impact materiality, companies must provide explanations if they choose not to disclose.

2. Greenhouse gas emissions data calculation is now a priority, highlighting the necessity and urgency of carbon management. The guidelines align with global disclosure trends, emphasizing climate-related management and setting detailed disclosure requirements for climate topics—beyond the four core requirements of governance, strategy, management of impacts, risks, and opportunities, and metrics and targets, the guidelines also propose key content such as climate resilience, transition plans, greenhouse gas emission accounting, and reduction measures, maintaining a high degree of consistency with international mainstream climate disclosure frameworks.

Notably, regarding greenhouse gas emission performance, the guidelines state that reporting entities should disclose the standards, methods, assumptions, or calculation tools used to account for greenhouse gas emissions, and explain the consolidation method (such as equity ratio, financial control, operational control, etc.). The guidelines also encourage reporting entities to disclose Scope 3 emissions where feasible and to hire third-party institutions to verify or audit the company's greenhouse gas emissions data. It is evident that the three stock exchanges aim to enhance the transparency and quality of carbon emission information and promote carbon reduction actions by strengthening the requirements for carbon emission accounting and disclosure by listed companies. Currently, companies face complex choices of methods and tools in the actual execution of climate-related quantitative analysis, which poses high demands on the professional knowledge levels of listed companies.

3. Topic selection aligns with international consensus and considers China's national conditions, maintaining distinct Chinese characteristics. In terms of disclosure topics, the guidelines are consistent with international mainstream reporting standards in addressing climate change, pollution prevention, resource utilization, supply chain management, and employee care. At the same time, they consider China's unique advantages and characteristics in the field of sustainable development, setting topics such as rural revitalization, innovation-driven development, and fair treatment of small and medium-sized enterprises, showcasing the breadth and depth of China's sustainable development philosophy.

[Conclusion]

In recent years, ESG disclosure by A-share listed companies has steadily improved, with companies placing greater emphasis on timely communication of their sustainable development concepts and achievements through the publication of standalone sustainability reports, ESG reports, or social responsibility reports. Analyzing the voluntary ESG disclosure practices of A-share listed companies over the past fifteen years, the average disclosure rate from 2007 to 2022 has fluctuated around 20% to 25%. In 2022, 1,455 A-share listed companies disclosed ESG or social responsibility reports, with a disclosure rate of 28.65%. As of June 2023, 1,738 A-share listed companies voluntarily disclosed ESG information, accounting for 33.28% of the total. (Data source: "China Listed Companies ESG Action Report (2022-2023)")

The release of these guidelines signifies the arrival of a unified and clear set of sustainability reporting standards for A-share listed companies. In the future, we can expect to see a significant improvement in both the quantity and quality of sustainability reports. From the perspective of ESG ratings, better and more comprehensive ESG disclosures will significantly enhance the rating levels of A-share listed companies. Similar to credit ratings, ESG ratings largely determine whether a company has investment value. Under this trend, the market size of investments related to sustainability, green, and low-carbon development is expected to continue expanding, accelerating the creation of a positive market ecosystem where sustainable disclosure and sustainable investment mutually reinforce each other.

We recommend that listed companies fully utilize the transition period to plan ahead for enhancing sustainability management and disclosure, identify and thoroughly assess sustainability priorities, and develop a robust sustainability governance system, set strategic goals and specific indicators, manage sustainability-related risks and opportunities, clarify their own carbon emissions and those of their supply chains, and implement corresponding reduction actions. Additionally, companies should layout or upgrade digital tools and information systems, gradually optimizing and continuously improving the quality of sustainability disclosure, enhancing investment value and investor returns, and promoting high-quality company development.

Links:

1. Shanghai Stock Exchange Self-Regulatory Guidelines No. 14 for Listed Companies —— Sustainability Report (Trial): http://www.sse.com.cn/lawandrules/sselawsrules/stocks/mainipo/c/c_20240412_5737862.shtml

2. Shenzhen Stock Exchange Self-Regulatory Guidelines No. 17 for Listed Companies —— Sustainability Report (Trial): https://www.sse.org.cn/aboutus/trends/news/t20240412_606840.html

3. Beijing Stock Exchange Continuous Supervision Guidelines No. 11 for Listed Companies —— Sustainability Report (Trial): https://www.bse.cn/uploads/6/file/public/202404/20240412194221_kes5c2ch9s.pdf