On June 26, 2023, the International Sustainability Standards Board (ISSB) officially released the first batch of global sustainability disclosure standards, including the International Financial Reporting Standards for Sustainability Disclosure No. 1 (IFRS S1) - General Requirements for Sustainable-related Financial Disclosures and the International Financial Reporting Standards for Sustainability Disclosure No. 2 (IFRS S2) - Climate-related Disclosures. These two standards will take effect on January 1, 2024.

In terms of greenhouse gas accounting, the ISSB's Climate-related Disclosures standard explicitly requires enterprises to disclose Scope 3 emissions, with financial institutions in asset management, commercial banking, and insurance required to disclose carbon emissions from financing and investment activities.

01

/ Current Status of Carbon Accounting Methods for Financial Institutions' Investments /

The direct emissions (Scope 1) and energy indirect emissions (Scope 2) generated by the operations of financial institutions are relatively small, but the value chain carbon emissions derived from investment activities are relatively large. According to research by the Global Environmental Information Research Center (CDP), investment activities constitute the main part of Scope 3 emissions for financial institutions, which can be up to 700 times the sum of the institution's Scope 1 and Scope 2 emissions. Carbon accounting for financial institution investments has long been one of the key challenges due to its broad involvement in industries and poor data availability.

Globally, regarding carbon accounting methods for financial institutions, the Greenhouse Gas Protocol (GHG Protocol) jointly released by the World Business Council for Sustainable Development (WBCSD) and the World Resources Institute (WRI) is the common standard for Scope 3 investment accounting by financial institutions. In 2019, with the increasing demand for disclosure of carbon accounting information for financial institution investments, the Partnership for Carbon Accounting Financials (PCAF) was officially launched globally. In 2022, PCAF released the latest version of its financing emissions guidelines.

Domestically, in 2021, the People's Bank of China compiled the Technical Guidelines for Carbon Accounting of Financial Institutions (Trial), stipulating that financial institutions should calculate the environmental impact and carbon emissions of their operational and investment activities. This guideline is also one of the standards for environmental information disclosure by financial institutions in China.

02

/ Introduction to Carbon Accounting Methods for Financial Institutions' Investments /

2.1 Greenhouse Gas Protocol (GHG Protocol)

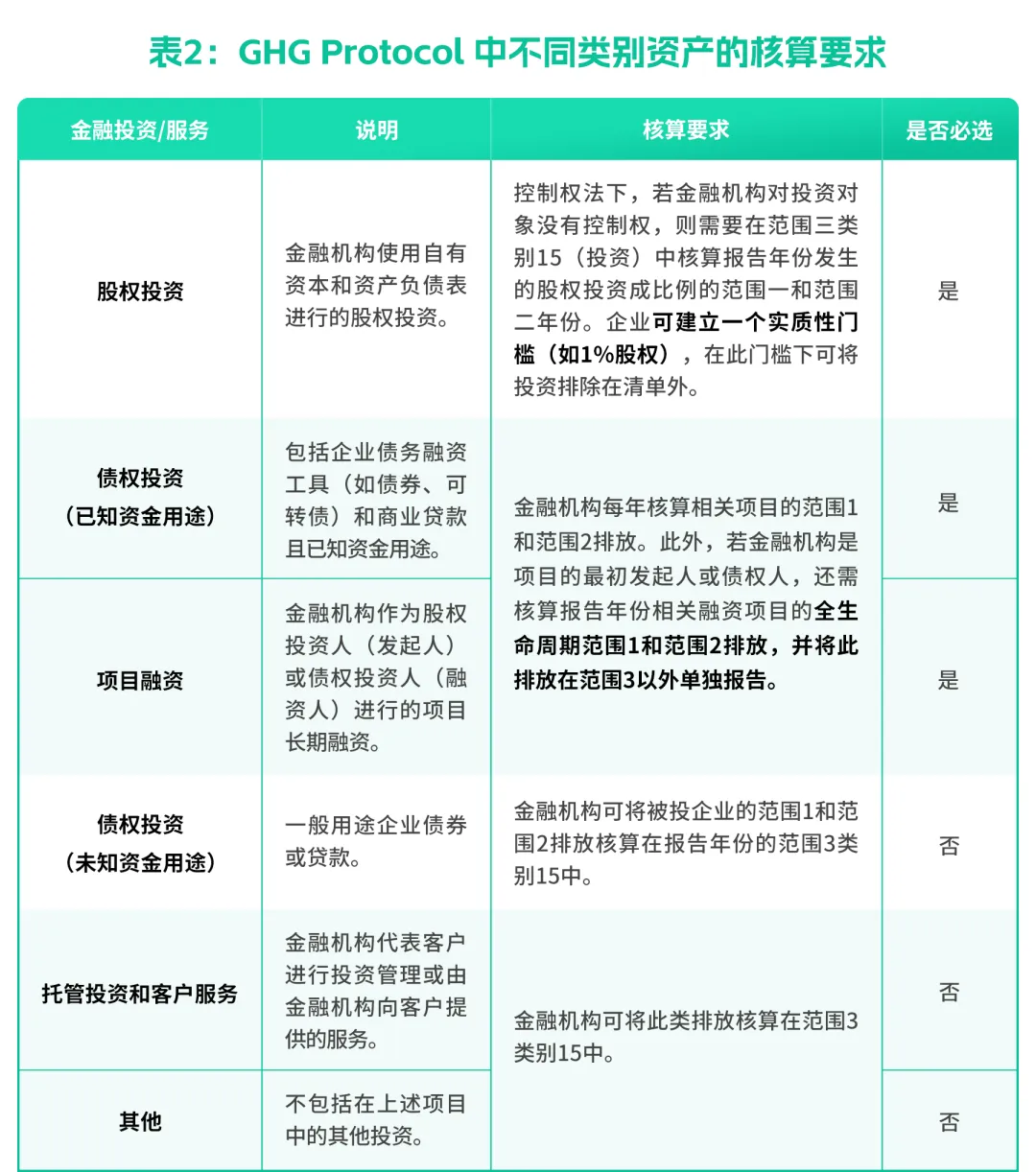

The GHG Protocol is a widely adopted standard for carbon accounting of financial institution investments. This standard primarily targets private financial institutions such as commercial banks, while public financial institutions like multilateral development banks and export credit agencies, as well as other entities requiring the calculation of investment emissions, can also refer to it. Generally speaking, the basic method for carbon accounting of financial institution investments is the product of the investee company's carbon emissions and the allocation ratio.

Due to the diversity and large number of investment assets involved by financial institutions, the GHG Protocol recommends that financial institutions first use average data methods to identify projects with significant contributions to carbon emissions, prioritize collecting real-world data for these projects, and estimate the rest using background data.

2.2 PCAF Financing Emissions Guidelines (2022)

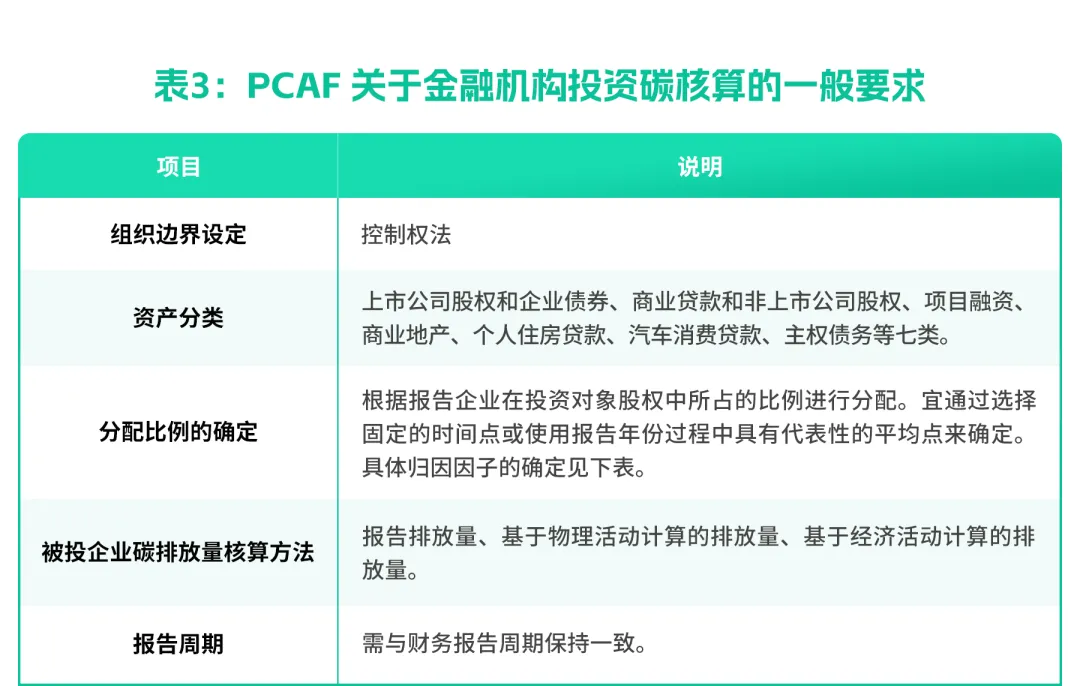

The PCAF Financing Emissions Guidelines are developed based on the GHG Protocol and are specifically targeted at greenhouse gas emissions accounting for financial industry investments.

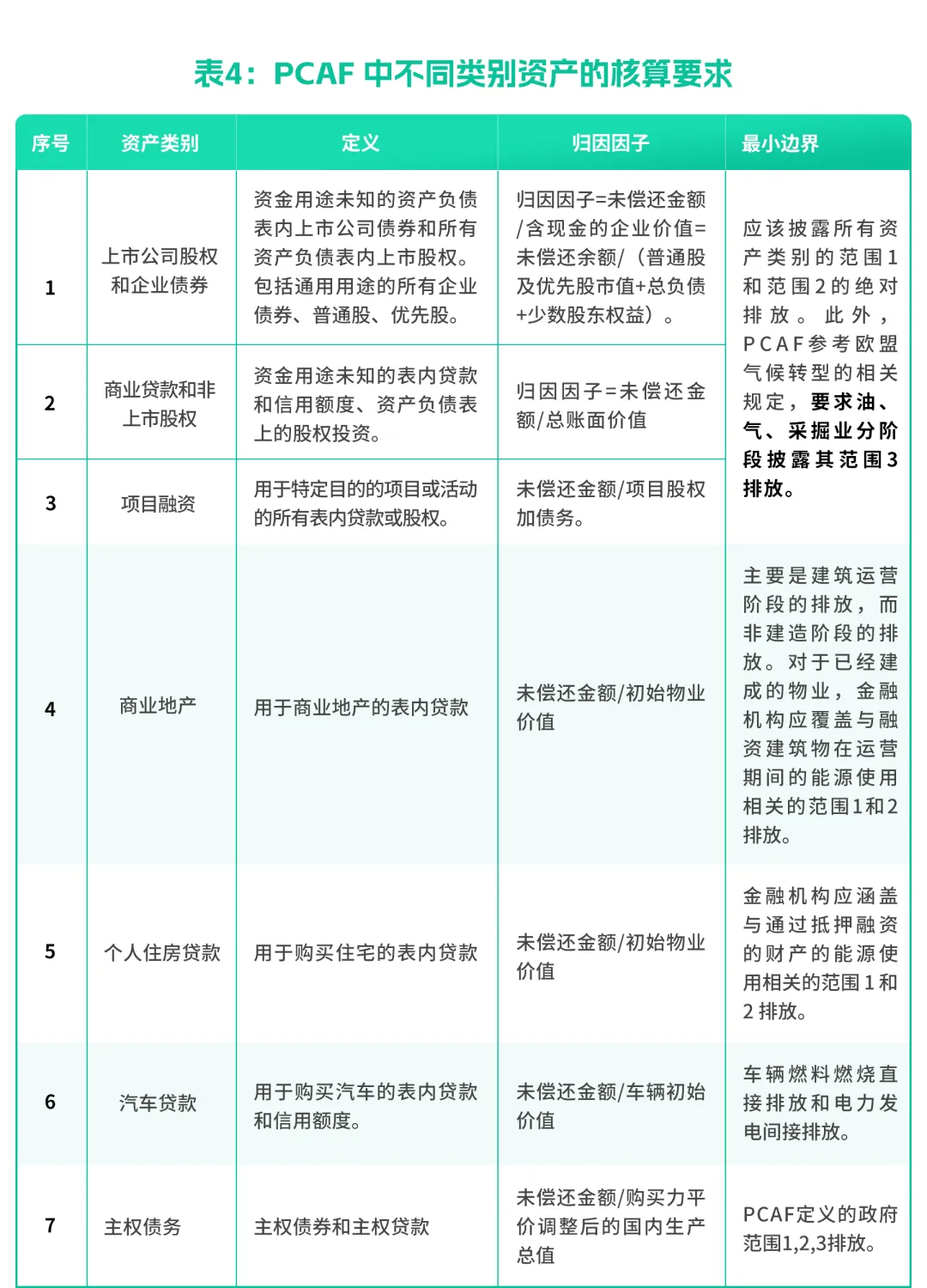

Compared to the GHG Protocol, PCAF provides more detailed explanations regarding asset categories, attribution factors, and data quality. Overall, the attribution factor for listed companies is calculated using the Enterprise Value Including Cash (EVIC) method, which must consider fluctuations in the market value of listed company shares; the attribution factor for unlisted companies is calculated using the book value method, based on the book value of total assets.

While PCAF provides relatively specific methods for calculating investment carbon emissions, it also has some issues. For example, when using EVIC as the denominator to calculate emissions, the indicator fluctuates with market price changes. Such market fluctuations may be merely due to market volatility and not related to the production activities or actual emissions of the invested entity. This is an issue with the PCAF method, and multiple financial institutions, including BMO Bank of Montreal, have pointed this out in their disclosure reports. Additionally, the PCAF standard has not yet covered all asset categories, and guidelines for other categories, including derivative financial products, may be released in the future.

2.3 PBOC Technical Guidelines for Carbon Accounting of Financial Institutions (Trial)

The Technical Guidelines for Carbon Accounting of Financial Institutions (Trial) issued by the People's Bank of China (PBOC) can be used by financial institutions to calculate carbon emissions and reductions related to their investment activities. This guideline is one of the primary standards followed by financial institutions in China for environmental information disclosure. The guideline categorizes asset types into project financing and non-project financing.

03

/ Comparison of Standards /

The main differences between the GHG Protocol, PCAF, and the PBOC carbon accounting guidelines are as follows:

In terms of reporting periods, the PBOC carbon accounting guidelines require reporting on a calendar year basis, while PCAF requires alignment with financial reporting periods. For mainland Chinese enterprises, the fiscal year aligns with the calendar year. However, for listed companies in regions such as the United States and Sweden, the fiscal year does not align with the calendar year, for example, many companies set their fiscal year from July 1 to June 30 of the following year.

In terms of asset classification, the PBOC guidelines have relatively simple classifications, dividing assets into two categories based on whether they are project financing. The GHG Protocol categorizes carbon accounting for financial institution investments into equity investments, debt investments, project financing, managed investments, and customer services, covering the main types of investment assets held by banks. PCAF further refines these categories based on the purpose of funds, dividing investment assets into seven categories: listed company equity and corporate bonds, commercial loans and unlisted company equity, project financing, commercial real estate, residential mortgages, auto consumer loans, and sovereign debt.

In terms of carbon emissions accounting, the underlying logic of the three standards in investment carbon accounting is the product of the investee company's carbon emissions and the allocation ratio, but there are differences in determining the attribution factor. For example, both the GHG Protocol and PCAF require selecting a specific time point to determine the outstanding amount (i.e., the numerator of the attribution factor), while the PBOC carbon accounting guidelines use monthly average data for calculations. For non-project financing, the GHG Protocol and PCAF generally require calculations based on the total value of the enterprise (i.e., the denominator of the attribution factor, where PCAF uses the EVIC method for listed company values), whereas the PBOC carbon accounting guidelines require using the enterprise's main business revenue as the denominator.

04

/ Effective Implementation of ISSB Standards: How Financial Institutions Should Account for Investment Carbon Emissions /

The two standards issued by the International Sustainability Standards Board (ISSB) will take effect on January 1, 2024. In the final standards, the ISSB explicitly requires entities to disclose their Scope 1, Scope 2, and Scope 3 greenhouse gas emissions, with financial institutions in asset management, commercial banking, and insurance required to disclose carbon emissions from financing and investment activities. In terms of accounting methods, the ISSB specifies that unless national or regional regulators or stock exchanges where the entity is listed require the use of different methods for greenhouse gas accounting, entities should use the GHG Protocol Greenhouse Gas Accounting System: Corporate Accounting and Reporting Standard.

Accounting for Scope 3 investment carbon emissions by financial institutions has been a hot topic and emerging issue in recent years. Apart from the GHG Protocol, which applies to carbon accounting across various industries, methods for investment accounting are still developing and being established. Currently, the most widely used method internationally is PCAF, with 154 financial institutions globally disclosing their investment carbon emissions calculated using the PCAF method. For environmental information disclosure, financial institutions in China widely adopt the PBOC carbon accounting guidelines.

In summary, with the increased requirements for disclosure of carbon accounting information for financial institution investments by market participants and regulators, it is expected that more and more financial institutions will account for and disclose carbon emissions from their Scope 3 Category 15 investments. Based on existing guidance for sustainable information disclosure, carbon accounting standards for financial institutions, and available data, it is recommended that financial institutions primarily use the GHG Protocol Greenhouse Gas Accounting System: Corporate Accounting and Reporting Standard, referring to the PCAF and PBOC carbon accounting guidelines for investment carbon accounting. It is suggested that financial institutions take practical steps first, using existing methods and available data for investment carbon accounting; simultaneously, they should gradually expand the range of asset categories included in Scope 3 investment carbon accounting and improve the quality of accounting data.

References:

1. PCAF Financing Emissions Guidelines:The Global GHG Accounting and Reporting Standard for the Financial Industry (carbonaccountingfinancials.com)

2. GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard:Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf (ghgprotocol.org)

3. International Financial Reporting Standards for Sustainability Disclosure No. 2 (IFRS S2) - Climate-related Disclosures:https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/#standard