Driven by the "dual carbon" goals, carbon credits have become a tool for enterprises to achieve the "last mile" of carbon neutrality. However, the carbon credit market is mixed, with project quality varying significantly, and many tech giants have previously fallen into "greenwashing" controversies due to purchasing low-quality carbon credits.

How can one screen truly effective carbon credits from the numerous global registered projects? Carbonstop will combine practical cases from global leading enterprises and the latest policy developments to provide a scientific selection guide for businesses and individuals.

Five Core Principles for Screening High-Quality Carbon Credits

1. Realness:

「The core of high-quality carbon credits lies in the verifiability of emission reductions. Projects should adopt scientifically accurate methods to quantify and monitor carbon emission reductions or removals, and require independent third-party verification to ensure data accuracy and reliability.」

Taking Microsoft's purchase of Direct Air Capture (DAC) credits as an example, its supplier 1PointFive's STRATOS facility ensures that each ton of sequestered carbon dioxide can be traced to a specific geological storage point through satellite remote sensing, ground sensors, and third-party monitoring. In contrast, certain rainforest protection projects that have been questioned rely solely on satellite imagery to estimate forest coverage, without considering variables such as illegal logging and pest infestations, resulting in actual emission reductions being overestimated by 400%.

Apple screens potential Restore Fund projects by conducting on-site visits and due diligence with managers before approval. To confirm that its projects meet strict quality standards, it uses satellite data analysis provided by Space Intelligence to conduct detailed assessments of the carbon impact of each investment and evaluates social and environmental impacts to ensure they align with the investment criteria developed in collaboration with Conservation International. Once a project is approved, it continues to be assessed for quality through verification and certification processes—such as the Project Design Document (PDD) program of the International Carbon Registry—and ongoing audits, satellite-based monitoring, and ground surveys supported by Upstream Tech and Space Intelligence.

2. Additionality:

「Additionality is a key metric for measuring the quality of carbon credits, meaning that the emission reduction benefits generated by the project cannot be achieved without carbon credit revenue.」

Unilever's clean cookstove project promoted in Kenya demonstrated through a comparison of local deforestation rates before and after project implementation that, without the project, household energy consumption would lead to a 25% annual increase in surrounding forest loss.

Walmart requires suppliers to prove that the emission reductions brought by carbon credit projects exceed the baseline required by local policies, meaning the emission reductions are "additional" compared to the mandatory requirements of local policies.

3. Permanence:

「For carbon removal projects, such as carbon capture and storage, it is necessary to ensure that carbon is removed and stored long-term and stably, avoiding re-release into the atmosphere due to accidents or human factors.」

Google's purchase of the Climeworks DACCS project in Iceland uses basalt mineralization technology to convert carbon dioxide into solid carbonates, with a geological storage period exceeding 1,000 years, and insures against risks of storage leakage. In contrast, mangrove restoration projects are often questioned for their carbon sink permanence due to vulnerability to typhoons and rising sea levels. Companies like Microsoft and Amazon have adopted engineered carbon removal technologies such as DACCS and biochar sequestration as long-term strategies, paying a premium of $140 per ton.

Gucci's mangrove restoration project in Brazil: insures against natural disasters such as typhoons and rising sea levels, with insurance claims triggered when carbon sink loss reaches or exceeds 15%.

4. Social Benefits:

「High-quality carbon credits need to balance environmental and community benefits, prioritizing projects linked to more than three United Nations Sustainable Development Goals (SDGs).」

Starbucks's biogas project in Colombian coffee plantations not only reduces carbon emissions but also improves soil with biogas residue, increasing coffee bean yields by 15% and farmers' incomes by 20%. Some controversial projects have been excluded from corporate procurement lists due to forced displacement of indigenous people and destruction of traditional livelihoods.

Apple requires carbon credit projects to be linked to at least three UN Sustainable Development Goals (SDGs), such as a Brazilian rainforest project that simultaneously supports biodiversity conservation (SDG15) and gender equality (SDG5).

5. Avoiding Double Counting:

「Ensure that carbon emission reductions are counted only once and are not reused in different projects or programs.」

• Registry System Verification: Confirm that the project is registered in only one international registry (e.g., Verra, Gold Standard) to avoid cross-border duplicate registration.

• Time Validity: Prioritize purchasing carbon credits issued within the last 5 years, and beware of "zombie credits" (credits issued before 2010 that have not been retired).

Jingdong Logistics uses blockchain technology to record the full lifecycle data of carbon credits, enhancing traceability. Microsoft's 2023 carbon credit procurement strategy accepts only credits issued after 2018.

The Impact of ISO 14068 on Corporate Use of Carbon Credits

ISO 14068-1:2023, the first international carbon neutrality standard, was released in November 2023, replacing the widely used PAS 2060 standard. This standard not only redefines the pathways to achieving carbon neutrality but also imposes stricter requirements on corporate strategies for using carbon credits.

1. Standardizing the Application Path of Carbon Credits, Strengthening the Priority of Emission Reduction

ISO 14068 explicitly requires enterprises to follow a hierarchical path of "emission reduction and carbon sink enhancement prior to offsetting," meaning enterprises must first reduce greenhouse gas emissions through technological upgrades, energy substitution, and other measures, then increase greenhouse gas removal through carbon sink projects, and finally consider using carbon credits to offset residual emissions. This principle requires enterprises to adjust their carbon neutrality strategies. For example, an automotive manufacturer originally planned to achieve carbon neutrality by purchasing large amounts of carbon credits. After following the ISO 14068 standard, it shifted to increasing R&D investment, adopting lightweight materials and efficient power systems, reducing per-vehicle carbon emissions by 25%, and only offsetting the remaining portion through standardized carbon credit projects.

2. Raising the Quality Threshold of Carbon Credits, Establishing a Strict Standard System

The standard sets higher requirements for the quality of carbon credits, emphasizing that they must meet core principles such as additionality and permanence, and establishes a strict standard system, initially allowing the use of emission avoidance or removal carbon credits, but only accepting removal credits after 2030.

3. Dynamic Carbon Neutrality Path and Long-Term Planning

Enterprises need to recognize that carbon neutrality is a long-term, dynamic process that cannot be achieved once and for all. They must strictly formulate carbon neutrality management plans and implement carbon neutrality measures, while gradually reducing reliance on carbon credit offsets over time, enhancing direct emission reduction and decarbonization capabilities. This means enterprises must plan the quantity and timing of carbon credit usage reasonably to ensure the sustainability of their carbon neutrality actions.

ISO 14068 requires enterprises to develop carbon neutrality plans covering more than 20 years and achieve goals in stages. For example, short-term goals (5-10 years) focus on emission reduction, while long-term goals (over 20 years) must rely entirely on removal technologies or zero-carbon emissions.

4. Enhanced Transparency and Anti-"Greenwashing" Mechanisms

ISO 14068-1 requires enterprises to publicly release corresponding carbon neutrality reports for each reporting period, including elements of the carbon neutrality management plan, the path and progress of carbon neutrality, uncertainties, descriptions of greenhouse gas emission reduction and removal projects in the reporting period, carbon credit mechanisms and greenhouse gas projects, verification opinions, etc. Carbon neutrality statements should be verified according to ISO 14064-3 or equivalent verification standards. This increases the transparency of information related to corporate use of carbon credits, prevents enterprises from abusing carbon credits for false advertising or "greenwashing," and enables the public and stakeholders to more clearly understand the true situation of corporate carbon neutrality actions.

Guide to Investing in and Procuring High-Quality Carbon Credits

The ISO 14068-1 standard emphasizes the principle of prioritizing emission reduction and using offsetting as a supplement, requiring all offsets to meet strict conditions. When enterprises purchase carbon credits to offset emissions that cannot be further reduced, they can start from the following aspects to select high-quality carbon credits to meet the standard requirements.

1. Ensure the Authenticity and Additionality of Carbon Credits

Verification of Carbon Credit Sources

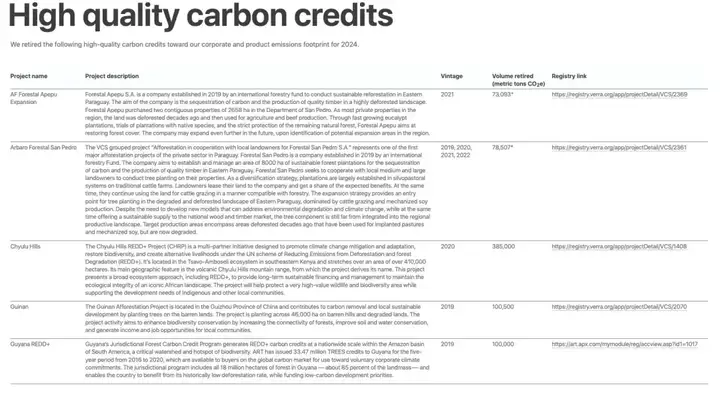

Obtain public documents such as project design documents, monitoring reports, and validation/verification reports from the official registry corresponding to the carbon credit (e.g., VCS: Verra Registry, GS: GSF Registry, etc.), verify key information such as project location, scale, project owner, and stakeholders; use the unique serial number of carbon credits in the registry for verification to ensure that the carbon dioxide emission reduction or removal corresponding to each ton of carbon credit is used only once.

Verification of Carbon Credit Additionality

The emission reduction or removal corresponding to carbon credits is additional only if it would not occur without the revenue from carbon credits. If a project would be implemented even without carbon credit revenue, such as when profits are high enough or driven by policy mandates, its carbon credits lack additionality.

When selecting carbon credits, enterprises can conduct basic research on the project activities corresponding to the carbon credits, primarily understanding:

① Whether such activities can bring high profits to the project implementer

② Whether the activities have become a common practice in the project location (behaviors or technological pathways that most projects or entities usually adopt under similar environmental and conditions, even without carbon market incentives)

③ Whether the project implementation is driven by local policy mandates

Carbon credits generated by projects driven by high profits, common practices, and policy mandates can lead to no actual emission reductions, thus undermining carbon reduction goals and dragging purchasing enterprises into "greenwashing" controversies.

2. Focus on the Timeliness of Carbon Credits

The use of carbon credits should be time-consistent with carbon neutrality goals, ensuring that offsetting actions have a real mitigating effect on current climate goals. When purchasing carbon credits, enterprises should pay attention to both the time when the emission reduction or removal effect occurs and the issuance time of the carbon credit, thus ensuring the environmental contribution of the carbon credit is genuine, compliant, and appropriately aligned with their own carbon neutrality claims.

Time of Carbon Credit Generation

The time of carbon credit generation refers to the year in which the greenhouse gas emission reduction or removal corresponding to the carbon credit actually occurred. It reflects the "temporal climate effectiveness" of the emission reduction action. If carbon credits from many years ago (5 years or more) are used, the emission reduction action only corresponds to the benefits at the time of generation, and its mitigating effect on current greenhouse gas concentrations has significantly diminished. At the same time, the logic of "offsetting" against current corporate emissions has already weakened.

Time of Carbon Credit Issuance

The time of carbon credit issuance refers to the date when the registry officially registers and issues the credits after verification by an independent third-party organization. It reflects the "version effectiveness" of the accounting methodology and regulatory requirements adopted in the carbon credit project development.

In recent years, rules and requirements in the voluntary carbon market have been continuously updated and improved, moving towards greater openness, transparency, and compliance. Many methodologies have been continuously revised and have introduced stricter additionality demonstration methods, with more stringent requirements for carbon leakage and the permanence of emission reductions or removals. Therefore, the newer the carbon credit issuance time, the more the project complies with the latest audit standards and aligns with the most recent requirements of the carbon market.

3. Screen Widely Recognized Carbon Standard Mechanisms and Methodologies

Prioritize carbon standard mechanisms with strict, robust management and review processes. Carbon credits issued under such mechanisms are also more widely recognized by the public. Enterprises can prioritize purchasing carbon credits with both CCP-Eligible and CCP-Approved labels.

The Integrity Council for the Voluntary Carbon Market (ICVCM) aims to scale up the size and efficiency of the voluntary carbon market to accelerate the achievement of the United Nations Paris Agreement goals on climate change. To enhance consistency across various carbon credit mechanisms and strengthen the integrity of the voluntary carbon market, ICVCM has developed assessment principles—the Core Carbon Principles (CCPs)—applicable to different global voluntary emission reduction mechanisms and methodologies.

The CCPs include ten core principles, evaluating carbon credit mechanisms and methodologies from three aspects: governance requirements, emission impacts, and sustainable development. If a carbon credit mechanism passes ICVCM's review, it is labeled CCP-Eligible; if a specific methodology under a CCP-Eligible mechanism passes ICVCM's review, it is labeled CCP-Approved. To continuously advance the achievement of global climate goals, the CCPs framework will also be iteratively updated.

As of now, carbon credit mechanisms that have passed ICVCM's preliminary approval include: American Carbon Registry (ACR), Climate Action Reserve (CAR), Gold Standard (GS), Verified Carbon Standard (VCS), Architecture for REDD+ Transactions (ART), and Isometric. Additionally, several smaller carbon credit programs are under review. A total of 12 carbon credit methodologies are recognized as compliant with CCP requirements, involving projects such as destruction of ozone-depleting substances (ODS) storage projects and landfill gas (LFG) projects.

4. Assess the Co-benefits Brought by Carbon Credits

Socioeconomic Benefits

High-quality carbon credit projects should generate significant social and economic co-benefits, not just focus on carbon reduction. Referring to the Gold Standard system, projects must be assessed by a third-party organization recognized by the standard to ensure benefits to local communities and bring lasting social, economic, and environmental benefits, such as creating short-term and long-term jobs for local residents, providing them with economic gains, and significantly improving their living environment through project implementation. When screening projects, enterprises can pay attention to whether the project reports its contributions to the Sustainable Development Goals (e.g., SDG 1: No Poverty, SDG 5: Gender Equality, SDG 8: Decent Work and Economic Growth, etc.).

Biodiversity Safeguards

CCB Standard (Climate, Community & Biodiversity Standards) measures climate-community-ecological co-benefits, providing a clear and practical labeling system for identifying projects with ecological and social safeguards from three dimensions: climate change, community activities, and biodiversity. The standard is led and managed by Verra, specifically designed for Nature-based Solutions (NbS), with specific project types including afforestation and reforestation, agricultural land management, wetland restoration, REDD+, etc.

CCB Standard certification levels are divided into CCB Validated and Gold Level. Projects with Gold Level certification achieve significant added value in at least one key dimension (e.g., saving endangered species, restoring critical wildlife habitats, etc.). When selecting nature-based carbon credits, if a project has the CCB label, it means that in addition to the corresponding carbon emission reduction or removal, the carbon credit has established a complete environmental impact assessment and monitoring system, actively addressing and adapting to potential risks such as deforestation, invasive species, and water stress; it also means the project aligns with international biodiversity framework goals, such as targets 2 or 3 of the Kunming-Montreal Global Biodiversity Framework (GBF).

5. Refer to Authoritative Carbon Credit Rating Systems

MSCI

MSCI's carbon project ratings independently assess the integrity of carbon credit projects based on multiple criteria, using the Integrity Council for the Voluntary Carbon Market's standards as a foundation. Each project is evaluated against six criteria and over fifty sub-criteria. Carbon credit integrity is divided into two categories: Emissions-Impact Integrity and Implementation Integrity, with each category comprising three dimensions.

CCQI

The Carbon Credit Quality Initiative (CCQI), co-founded by the Environmental Defense Fund, World Wildlife Fund (WWF-US), and oeko-institute, provides transparent information on the quality of carbon credits.

CCQI has released a carbon project rating tool on its website, which is transparent and publicly discloses all scoring items and calculation rules for all users. Based on extensive research on carbon credit projects and stakeholder surveys, its project rating methodology evaluates projects from seven aspects: project additionality, avoidance of double counting, project permanence, contribution to net-zero emissions, governance, social impact, and host country climate goals, freely helping every enterprise or individual seeking to purchase high-quality carbon credits to distinguish credit ratings.

BeZero

BeZero is a professional carbon credit rating agency headquartered in London, founded in 2020. The company helps investors, project developers, and intermediaries assess the effectiveness and risks of carbon credits through an independent, risk-based rating system, thereby promoting investment in high-quality climate projects. The company emphasizes independence, does not participate in carbon project development, trading, or verification, avoids conflicts of interest, and makes all ratings and methodologies publicly transparent for public review.

BeZero's carbon project risk assessment framework includes key factors such as additionality, over-issuance, carbon leakage, permanence, carbon buffer pools, information, policy, and MRV systems. For technology-based projects (e.g., biochar) and nature-based projects (e.g., forestry, soil) that receive more attention, BeZero provides more detailed scoring methodologies.

The above only lists three relatively common rating methods. Enterprises can refer to more carbon credit rating information when purchasing carbon credits, truly "comparing multiple options." By comparing assessment frameworks and results from different rating agencies, enterprises can not only more clearly identify the environmental effectiveness and risks of carbon credits but also prioritize carbon assets with high transparency and credibility in their carbon neutrality strategies. Using third-party ratings as a "quality magnifier" is an important step towards achieving high-quality climate responsibility and sustainable value creation.

The global carbon credit market is expected to reach $50 billion by 2030, but high-quality credits account for only 14%. With the introduction of ISO 14068, the carbon credit market is shifting from "quantity competition" to "quality competition." Enterprises need to move beyond the "low-price first" mindset and address challenges with technological innovation and long-termism. Individual consumers can refer to models like Apple's "product carbon labeling" and Microsoft's "game carbon footprint subscription package," integrating carbon credits into daily choices.

Facing the growing demand from enterprises for high-quality carbon credit procurement and investment, Carbonstop, with its core of "One-stop Carbon Asset Management Services," covers innovative methodology development (focusing on social benefits), high-quality carbon credit investment and procurement, and full-process development and management of carbon asset credits, is redefining the boundaries of carbon asset

business. Whether it's transforming绿水青山into金山银山through forest carbon sinks, directly purchasing spot and futures of high-quality carbon credits, or activating public low-carbon consumption through a second-hand goods recycling platform while helping enterprises gain additional carbon reduction benefits, Carbonstop is providing practical pathways for enterprises and individuals to participate in carbon neutrality, ultimately enabling more enterprises and

products to move towards carbon neutrality and contribute to the realization of global net-zero emission goals.

As Microsoft's Senior Director of Carbon Removal stated: "Purchasing carbon credits is not a 'get-out-of-jail-free card,' but an investment in future climate technologies." Only in this way can the carbon market truly become a powerful tool to combat climate change, rather than a breeding ground for "greenwashing," enabling enterprises to achieve a win-win between environmental benefits and commercial value in the race to carbon neutrality.