摘要:通过碳阻迹专业咨询与技术赋能,大钲资本完成了企业碳盘查、碳中和目标制定、路径规划等工作,开启应对气候变化新征程。

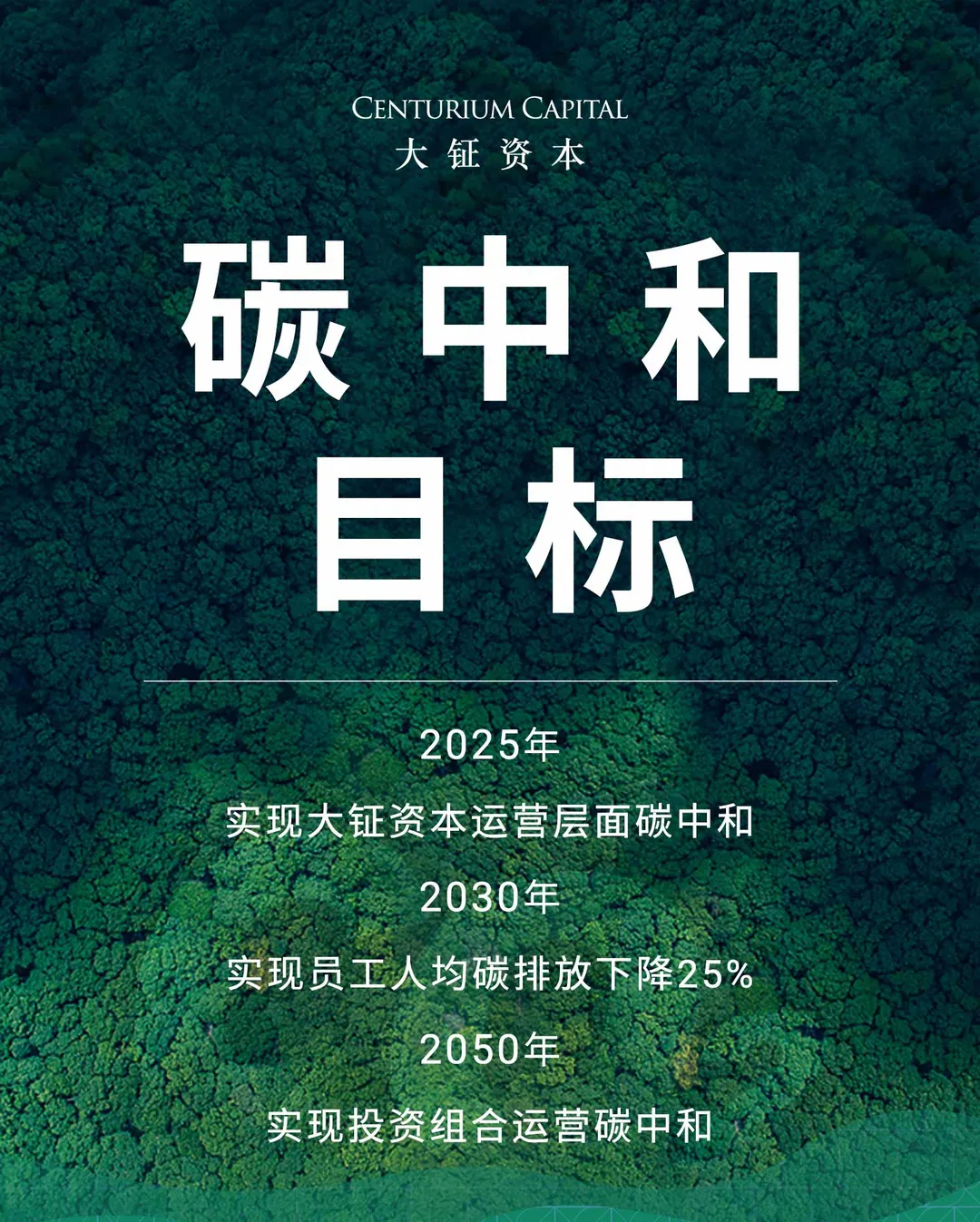

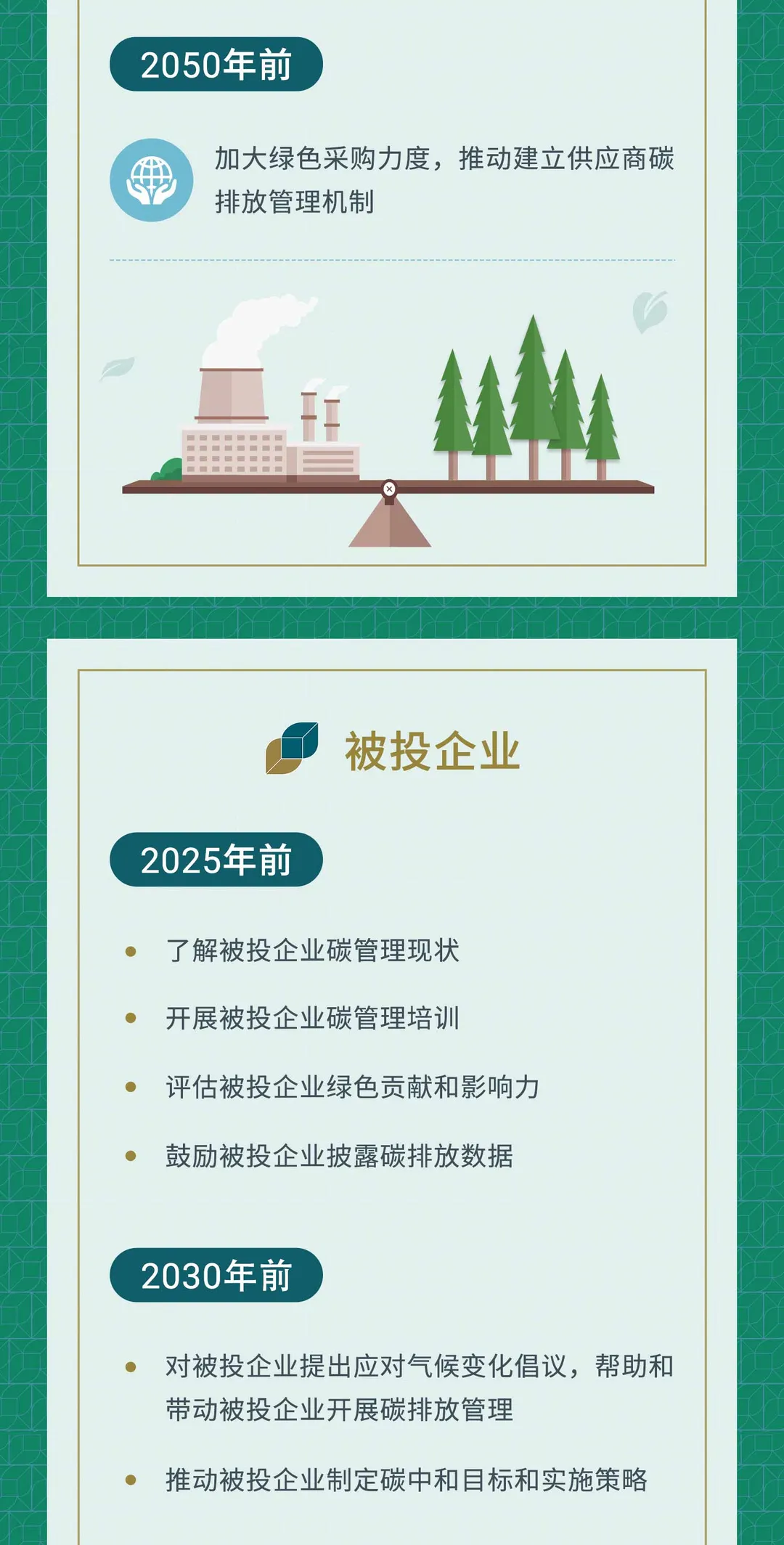

日前,中国领先的私募股权基金投资管理公司大钲资本正式公布碳中和路线图,并计划于2025年在公司运营层面实现碳中和,于2050年实现投资组合运营碳中和。此外,大钲资本还积极鼓励员工低碳绿色生活方式,并为其提供可行的实施方案,以期在2030年前将员工人均碳排放下降25%。

01

企业简介

大钲资本(Centurium Capital)是中国领先的私募股权基金管理公司,专注于中国医疗健康、硬科技、消费升级及企业服务领域的投资机会。自成立以来,大钲资本已投资了约30家企业,如瑞幸咖啡、泰邦生物集团、安能物流、天数智芯等。大钲资本秉承“投资驱动变革”的理念,对选定的公司和企业家进行长期投资,帮助企业制定有效的经营策略及提高运营效率,推动企业成长和行业变革。

02

案例背景

时至今日,碳达峰、碳中和已成为全球共识,各行各业都在积极应对这场没有硝烟的博弈。金融行业也投身其中,通过提供“源头活水”,在实现碳中和的进程中扮演着举足轻重的角色。

一直以来,大钲资本在股权投资过程中融入了一系列ESG评估标准。而为了响应碳达峰及碳中和号召,将负责任投资原则、ESG以及可持续发展理念进行到底,大钲资本2021年开始了自身碳中和探索之旅。

03

金融机构“碳中和”,从何做起

碳阻迹丰富的实战经验与成熟的数字化能力,为大钲资本的“碳中和”之旅提供了解决方案。作为国内较早探索碳中和路径的私募股权投资机构,大钲资本也为整个行业的碳中和之路提供了宝贵的参考。

关于企业如何实现“碳中和”,碳阻迹创造性地提出了“CREO”方法论,并将其贯穿运用于企业碳中和始终。

“CREO”方法论:

- Calculating(计算):量化碳排放永远都是碳排放管理的重中之重;

- Reducing(减少):核算完碳排放数据后,企业首先应该想到的是尽可能去减排,而不是选择抵消和中和;

- Engaging(带动):除了企业自身的减排,如何调动生态伙伴共同减排,这才是价值更大的地方;

- Offsetting(抵消):当企业“减无可减”,还是有不可避免的碳排放之时,可以选择种树或者购买碳信用等抵消那部分不可避免的碳排放,实现“零排放”。

「摸清探家底」

如果把碳中和比作一段旅程,那量化碳排放则是旅程的起点。没有量化就没有管理,没有管理就没有碳中和。

在碳阻迹专业支持下,大钲资本快速完成边界确定与排放源识别。然而,在数据收集与核算环节,由于大钲资本的运营边界覆盖广,涉及员工差旅、出行等,同时排放源种类多元,为碳排放量的核算增加了难度。

为此,碳云依托15万+碳排放因子数据库,智能合规的算法模型为大钲资本的碳核算提供了“最优解”。此外,碳云推出“在线认证”服务,实现与全球头部第三方认证机构、核算类产品报告接口的“双打通”。从“核算-报告产出-提交认证资料-完成认证”,令企业纵享极致流畅的认证体验。

在碳云的加持下,企业碳排放核算效率将提升90%以上。

「科学制定碳目标」

核算完自身碳排放后,面对错综复杂的碳数据,不知该如何将数据“价值化”,是大多数企业碳管理的痛点。想要解决痛点,首先要做的就是制定碳中和目标及其实施路径。

在大钲资本碳中和目标制定过程中,碳阻迹采取了“CFOS”原则。

“CFOS”法则:

- Calculating(计算):制定碳中和目标的第一步是量化碳排放;

- Forecasting(预测):量化完成后,要关注国家/地区层面减碳力度、企业自身业务发展趋势、碳减排、碳中和成本以及传播品牌效应;

- Overshooting(超越):企业应根据国家和同行的碳中和目标来选择自己中和的年份;

- Spreading(传播):碳中和目标越早提出能体现行业领先性。

同时,碳阻迹还结合企业业务发展趋势、碳中和成本,以及其从范围一到范围三中10+种排放源,为大钲资本打造专属碳减排路径。

通过碳阻迹专业咨询,以及数字化技术赋能,大钲资本完成了企业碳盘查,碳中和目标制定以及实施路径规划。

未来,碳阻迹将持续为金融行业提供智能高效、专业权威的碳中和服务,赋能更多企业搭乘“双碳”之风,浩浩荡荡,共赴山海。