Introduction

CDP (Carbon Disclosure Project) is one of the most recognised disclosure frameworks in the world and is shaping how companies respond to corporate climate reporting. It is used by investors, customers, lenders, and procurement teams to assess how companies identify, manage, and reduce climate-related risks across their operations and value chains.

For many corporate leaders, CDP is no longer a fringe reporting exercise. It is a strategic tool that links corporate carbon data, supply chain engagement, investor expectations, and emerging regulatory requirements.

This article explains what CDP is and why high-quality primary data is essential for creating an effective climate disclosure.

What is CDP and Why It Matters

CDP has become one of the most widely used frameworks for assessing corporate climate reporting. Its disclosure covers a range of environmental topics, such as climate change, water security, forests, plastics, and biodiversity. Companies respond annually using online questionnaires, through which they disclose governance, emissions results, risk management practices, and approaches to manage the transition to net zero.

While CDP remains a voluntary framework, its influence is considerable. CDP data is requested by hundreds of institutional investors and large corporate buyers, making participation increasingly important for access to capital and building strong supply chain relationships.

In practice, CDP increasingly functions as an early indicator of corporate climate governance and data maturity.

How the CDP Corporate Questionnaire Works

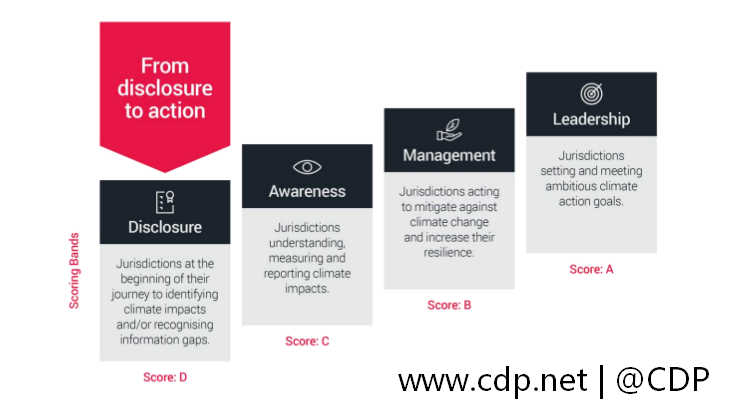

The CDP Corporate Questionnaire, often referred to as the CDP survey, is the primary tool through which companies disclose climate-related information. Responses are assessed, and the overall response is scored from A (Leadership) to D (Disclosure).

The questionnaire covers the following thematic areas:

- Governance: Board- and executive-level oversight, including accountability and review processes

- Risks and opportunities: Identification and assessment of physical and transition risks, including their potential financial implications across defined short-, medium-, and long-term time horizons

- Corporate GHG emissions inventory: Disclosure of Scope 1, Scope 2, and Scope 3 emissions in line with the GHG Protocol

- Reduction targets and performance: Definition of emissions reduction targets, including alignment with science-based targets

- Strategy: Explanation of how climate considerations are embedded into business and financial planning

- Value chain engagement: Supplier engagement and influence over upstream emissions

The CDP Corporate Questionnaire is also aligned with other global frameworks, including ISSB and TCFD-aligned concepts, while remaining a distinct voluntary disclosure system. CDP increasingly expects companies to demonstrate disclosure quality as well as consistency, documentation, and internal review processes that support the credibility of reported data.

CDP and the Growing Pressure on Supply Chain Emissions

Companies are increasingly expected to accurately calculate and report their Scope 3 emissions, particularly purchased goods and services, and demonstrate active engagement with suppliers. For many organisations, this represents the most challenging aspect of CDP reporting.

This is especially true for companies sourcing from China and other Asian manufacturing hubs. Their emissions data are difficult to obtain due to an extensive number of suppliers and the fact that emission intensities vary significantly by region and manufacturer, depending on energy mix and production processes.

While generic emission factors remain acceptable at a baseline level, they are increasingly insufficient for organisations aiming to demonstrate maturity, improvement over time, or leadership in Scope 3 management. Generic emission factors and manual data collection represent a significant challenge to credible disclosure, particularly as CDP places greater emphasis on primary data and supplier engagement.

CDP is increasingly placing emphasis on data completeness, consistency, traceability, and evidence of supplier engagement. As a result, the quality of underlying emissions data has become a key determinant of both CDP scores and the confidence stakeholders have in corporate disclosures.

CDP assessment also rewards year-on-year improvement, including expanding Scope 3 coverage, more extensive supplier engagement, and refinement of the methodology used for annual disclosures.

From Disclosure to Data Infrastructure

CDP is often described as a reporting framework, but its real impact is operational. Responding effectively requires organisations to connect sustainability strategy with systems that can support:

- Consistent Scope 1–3 emissions calculations aligned with the GHG Protocol

- Supplier engagement at scale, including primary data collection and increasing value chain coverage

- Clear audit trails from raw data to disclosed figures

- Alignment between CDP responses and other reporting obligations, such as CSRD and ISSB

CDP increasingly assesses whether emissions reduction targets are supported by credible transition plans, including defined decarbonisation levers, interim milestones, and dependencies across the value chain.

- This is where enterprise carbon management platforms become critical. Carbonstop supports CDP reporting by providing the underlying infrastructure needed to move beyond disclosure toward repeatable, assurance-ready processes.

- Key capabilities include:

- China-specific emission factors that reflect local grids, materials, and industrial processes, improving accuracy for global supply chains

- Structured supplier engagement workflows that enable primary data collection, track participation, and demonstrate year-on-year improvement

- AI-enabled validation to identify anomalies, gaps, and inconsistencies across data

- Audit-ready workflows that support internal review, and third-party assurance

- Automation of CDP questionnaire responses, pre-scoring of disclosure quality and providing targeted recommendations

By embedding these capabilities into day-to-day operations, organisations can respond to CDP more efficiently while reducing disclosure risk.

CDP, Regulation, and What It Does Not Replace

CDP does not replace regulatory reporting requirements such as CSRD or CBAM, nor does it provide legal safe harbour. However, it increasingly acts as an early indicator of regulatory readiness.

Companies that rely on ad-hoc processes to respond to CDP often struggle to adapt when regulatory requirements tighten. Conversely, organisations that treat CDP as part of an integrated carbon data strategy are better positioned to meet expectations from a range of stakeholders.

Conclusion

CDP is likely to play a crucial role in assessing corporate climate response. For sustainability leaders, the question therefore is no longer whether to respond to CDP, but whether their organisation has the appropriate systems, sufficient capacity, and data to do so in a credible and consistent manner.

Organisations that invest in accurate, audit-ready emissions data and supplier engagement are better positioned to perform strongly across CDP assessment categories, respond to regulatory change, and build long-term trust with stakeholders.

Learn how Carbonstop supports CDP reporting with accurate Scope 1, Scope 2, and Scope 3 data, China-specific emission factors, AI-enabled validation, automated CDP responses, pre-scoring of disclosure quality and providing targeted recommendations.