The Evolving Landscape of SEC and Global Climate Disclosure

The Evolving Landscape of SEC and Global Climate Disclosure

Climate disclosure is entering a new phase. In the US, the Securities and Exchange Commission (SEC) has developed climate-related disclosure requirements for public companies. While this is currently subject to a judicial review and its enforcement is paused, its requirements focusing on material climate risk, governance, and audit requirements are most likely here to stay.

For sustainability leaders, this represents a significant corporate reporting change and challenge. Climate reporting is no longer a standalone exercise. It is receiving scrutiny from auditors, regulators, investors, and boards and, therefore, is treated as a governance, risk, and assurance issue.

This raises a critical question, can existing, largely manual ESG reporting processes withstand this new era of financial-grade regulatory enforcement? For most enterprises, the answer depends on whether carbon management is supported by auditable, enterprise carbon management software rather than far more robust than decentralized spreadsheets and ad-hoc workflows.

Why Manual Processes are not Sufficient for Regulatory Reporting (SEC & CSRD)

Regulated reporting imposes strict requirements on data quality, auditability, and internal controls. This can present a challenge for manual processes.

1. Meeting Assurance Requirements for Scope 1 & 2 under SEC

Companies are expected to report climate-related risks, governance, and greenhouse gas (GHG) emissions results with a rigour comparable to financial reporting.

For example, Scope 1 and Scope 2 emissions disclosures must be supported by assurance. Large Accelerated Filers (LAFs) will face a phased-in requirement, starting with Limited Assurance and progressing to Reasonable Assurance by the 2033 fiscal year.

Relying on manual systems, spreadsheets and decentralised data spread across different systems and sources lacks the necessary:

- Version control and data consistency.

- Standardised calculation methodologies.

- Robust, contemporaneous audit trails to satisfy external auditors.

- These limitations create material compliance and assurance risks, threatening the integrity of the required disclosures.

2. The Scope 3 Challenge

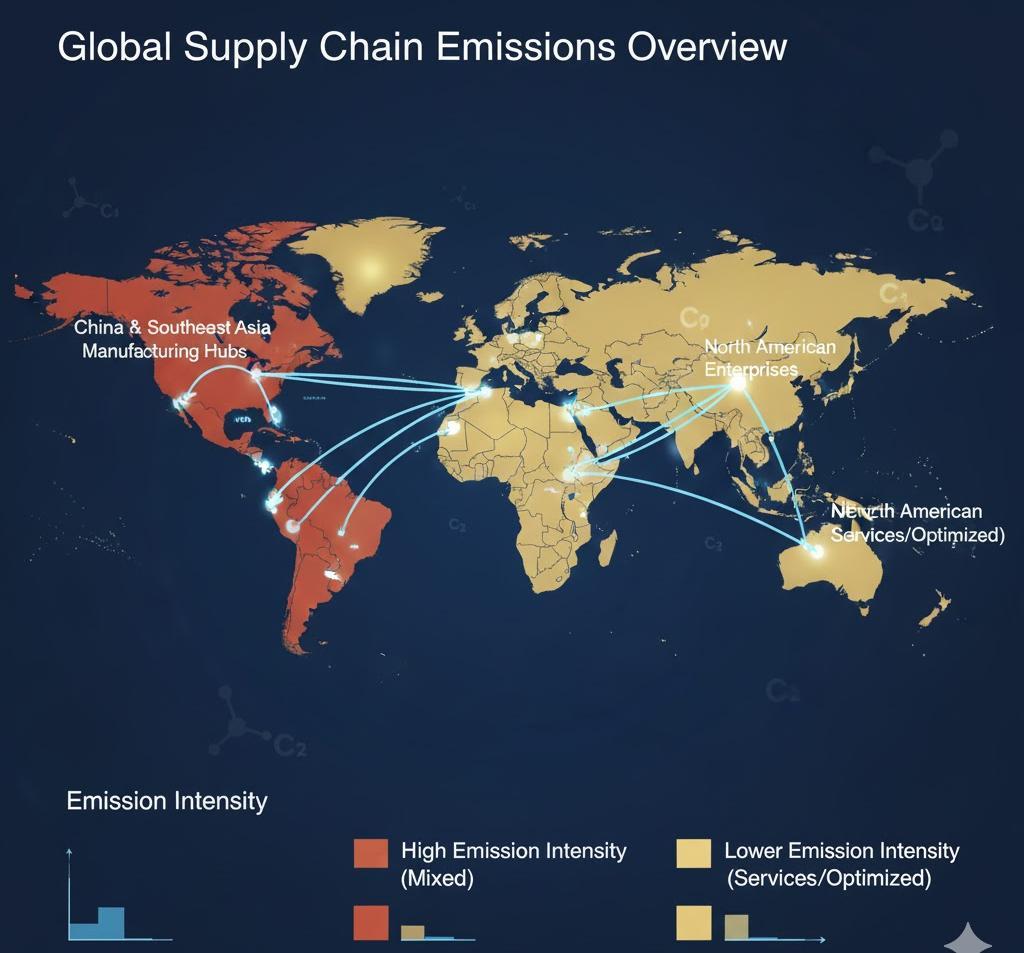

Scope 3 emissions account for the majority of the carbon footprint of many businesses. These emissions span across global supply chains and rely on large volumes of supplier, logistics, and product-level data.

Crucially, while the final SEC rule eliminated mandatory Scope 3 disclosure, these emissions are explicitly required under other pressing regulations, such as California’s SB 253 (Climate Corporate Data Accountability Act) and the EU’s CSRD. They also remain a primary focus for institutional investors.

Given their complexity and size, managing data collection manually introduces inconsistency and error. Without standardised processes and accurate, region-specific emission factors, companies cannot produce reliable inventory results. This challenge is particularly significant for organisations sourcing from China and other Asian manufacturing hubs, where emissions intensity varies widely by energy mix and production process.

3. Continuous Monitoring

Climate risk does not operate on an annual reporting cycle. Operational changes, supplier disruptions, changes in product mix and product specification or shifts in energy sourcing can materially affect corporate emissions. Without this, companies risk discovering critical data gaps or material issues only at reporting time, which impacts decarbonisation strategy.

How Enterprise Carbon Management Software Enables Compliance

Carbon management software for enterprises replaces fragmented data handling with the necessary infrastructure to meet rigorous regulatory and assurance demands.

A Single Source of Truth for Carbon Data

Carbon management platforms for businesses establish a centralized system of record for carbon data. By integrating directly with enterprise systems (ERP, procurement, energy management), they ensure consistent data flows and calculation methodologies across the organisation.

Carbonstop’s platform, for example, supports automated matching of activity data to appropriate emission factors, drawing on extensive, region-specific datasets. This includes China-specific emission factors, which are critical for enterprises with manufacturing or supplier exposure in the region and materially improve the accuracy of reported emissions for global compliance.

Alignment with Converging Reporting Frameworks

Carbon management platforms for businesses are designed to align with recognized accounting (GHG Protocol) and reporting standards, including the ISSB, CSRD/ESRS, and CDP. This standardisation reduces the need for parallel reporting processes and helps ensure internal consistency across multiple disclosure frameworks.

Carbonstop’s modular approach allows organisations to adapt as requirements evolve (e.g., as the SEC rules are finalized or as CSRD expands), without having to rebuild systems from scratch.

AI-Supported Audit and Quality Control

As volume of data grows, manual quality assurance becomes time consuming and resource intensive. AI-enabled validation plays an important role in identifying data anomalies, filling data gaps, and identifying inconsistencies in data before results are calculated and disclosed.

Carbonstop applies AI to support emission factor selection, data completeness checks, and internal review processes. This strengthens data credibility and supports audit-ready workflows, significantly reducing the risk of material misstatement.

Beyond Compliance: Turning Data into Decarbonisation Strategy

While compliance is the immediate driver for many organisations, high-quality carbon data is a critical for strategic decision-making and value creation by enabling:

- Strategic Decarbonisation: Accurate data allows leaders to identify emissions hotspots, evaluate decarbonisation trade-offs, and prioritize capital expenditures.

- Effective Supplier Engagement: Effective Scope 3 management depends on comprehensive collaboration with suppliers. Using tools enable companies to collect primary data from their suppliers, track participation and engagement, and measure year-on-year improvement across their supplier base.

- Stakeholder Credibility: Transparent, auditable disclosures supported by validated systems improve confidence among investors, customers, and other stakeholders.

Conclusion: Future-Proofing ESG Reporting in a Regulated Era

The next few years will play an especially important role in climate reporting. SEC disclosures, CSRD implementation, and ISSB-aligned standards will reshape expectations globally. In this context, a digital carbon management platform for enterprises is no longer optional.

Sustainability leaders should begin with a clear assessment of where manual processes introduce risk and prioritise carbon management software that supports accuracy, scalability, and assurance.

Organisations that invest in appropriate tools, data, and supplier engagement will be better positioned not only to comply with regulatory requirements but also become more competitive.

Ready to Build Your Audit-Ready System?

Carbonstop can help enterprises build audit-ready systems aligned with global reporting standards and complex supply chains. This ensures organisations move from compliance readiness toward long-term decarbonisation and value creation.

Schedule a demo today to align your carbon accounting with the new era of financial-grade disclosure and move from compliance readiness toward long-term value creation.